Belgium’s logistics market draws global capital as investment surges past expectations

The first half of 2025 has marked a turning point for Belgium’s logistics real estate sector, with investment volumes reaching levels not seen in recent years.

01 October 2025

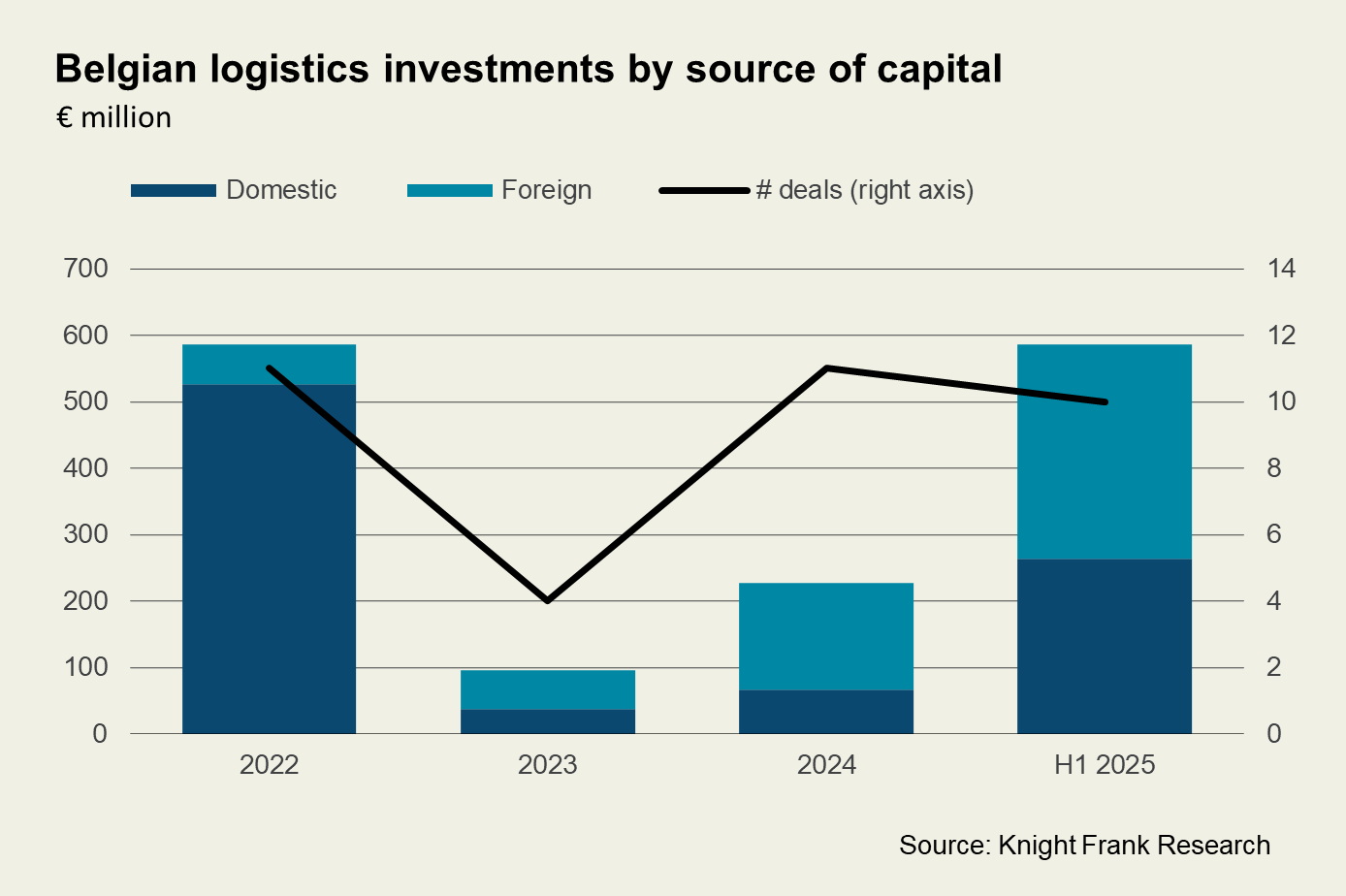

According to Knight Frank’s latest Belgian industrial market report nearly €587 million was invested in logistics assets during the first six months alone—already exceeding annual totals from the previous four years.

International capital gains ground

This surge is not merely quantitative. It reflects a shift in investor composition, with international capital playing a more prominent role in a market traditionally dominated by domestic players. Notably, US investors accounted for €211 million, or 36% of total logistics investment in H1, while German capital also featured prominently.

Traditional market appeal and value-added strategies

Among the standout transactions is Deka Immobilien’s acquisition of the 65,000 sq m Kellogg’s distribution centre in Mechelen, a zero-carbon asset with BREEAM Excellent certification. Located on the Brussels–Antwerp axis, the deal underscores the strategic appeal of Belgium’s central position within Europe’s transport infrastructure.

The report also highlights a growing trend among Belgian developers and owners: a pivot toward value-added strategies, including the reconversion of older industrial sites into modern logistics facilities. A prime example is WDP’s €100 million purchase of the former Renault site in Vilvoorde, which is set to be transformed into a logistics hub.

Looking ahead, the market is poised to cross the €1 billion investment threshold in 2025, with the sale of a five-asset portfolio by Weerts to Intervest expected to add another €300 million in Q3. This momentum suggests that Belgium’s logistics sector is not only resilient but increasingly attractive to a broader pool of institutional investors.

Stable yields and strong fundamentals support confidence

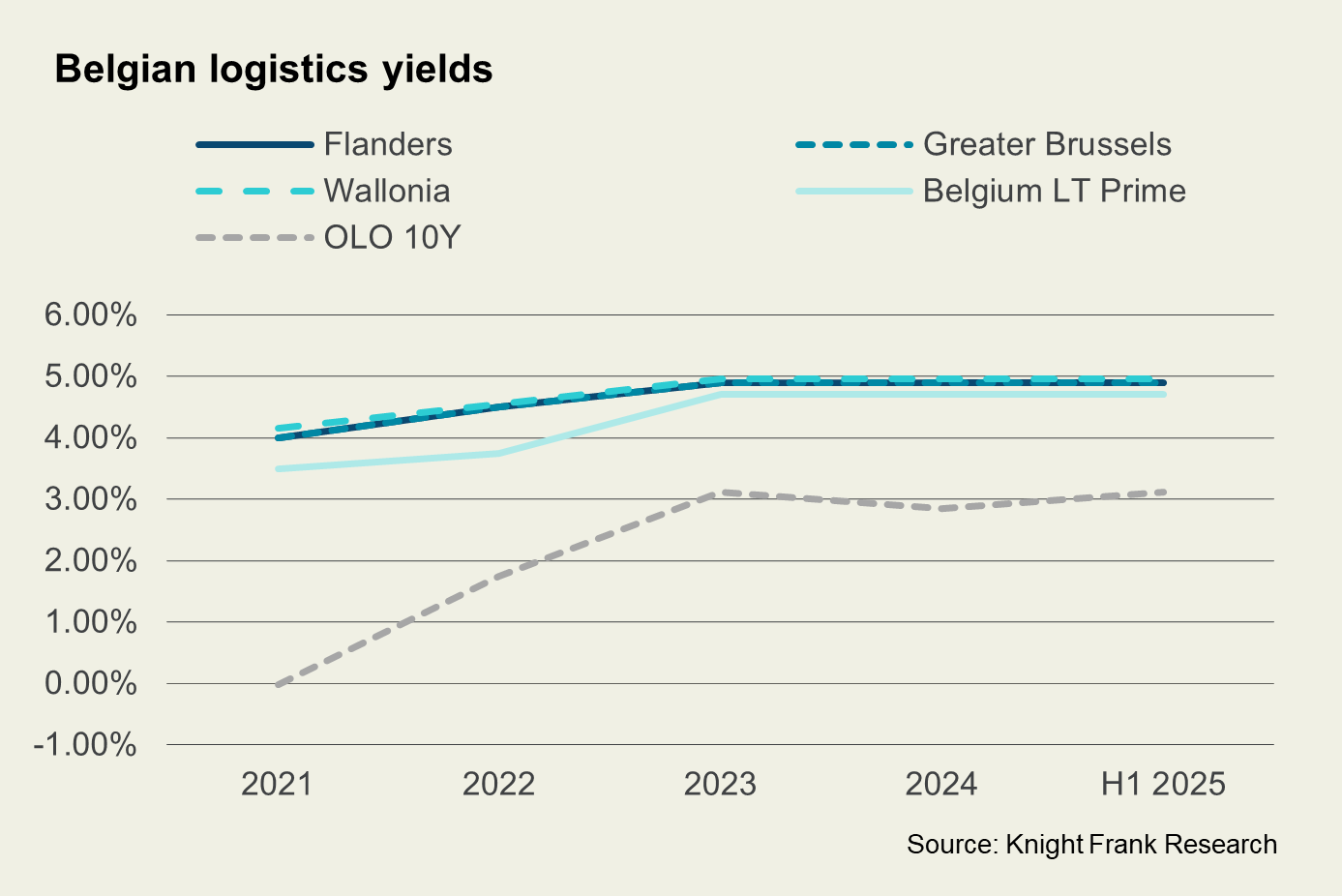

Yields have remained stable, with prime logistics assets trading at 4.90%, and long-term lease covenants at 4.70%. Combined with low vacancy rates and strong occupier demand, the fundamentals continue to support robust investor confidence.

Outlook: stability and strategic relevance in a shifting global landscape

For investors and occupiers seeking strategic positioning in Europe, the Belgian logistics market offers a compelling proposition. Its performance in H1 2025 reflects not only sector-specific strength but also broader macroeconomic stability. With GDP growth forecast at 1% annually through 2027 and inflation expected to fall below 2% by 2026, Belgium remains a relatively stable environment in an otherwise uncertain global landscape.

As geopolitical tensions and supply chain vulnerabilities persist, the country’s infrastructure, connectivity and investor-friendly fundamentals position it as a key node in Europe’s industrial future.