European Leading Indicators - November 2025

European CRE investment, prime office rents & growth outlook November 2025 update

20 November 2025

European Leading Indicators - November 2025

Cross-border momentum, risk-free rates & manufacturing rents

Written by Judith Fischer, Partner, European Commercial Research

Key insights:

- International capital into Europe (excl. UK), including pending deals, totals €57bn YTD, according to MSCI Real Capital Analytics. Cross-border activity is seeing increasing momentum, with countries such as Germany, France, Sweden and Denmark already surpassing last year’s totals.

-

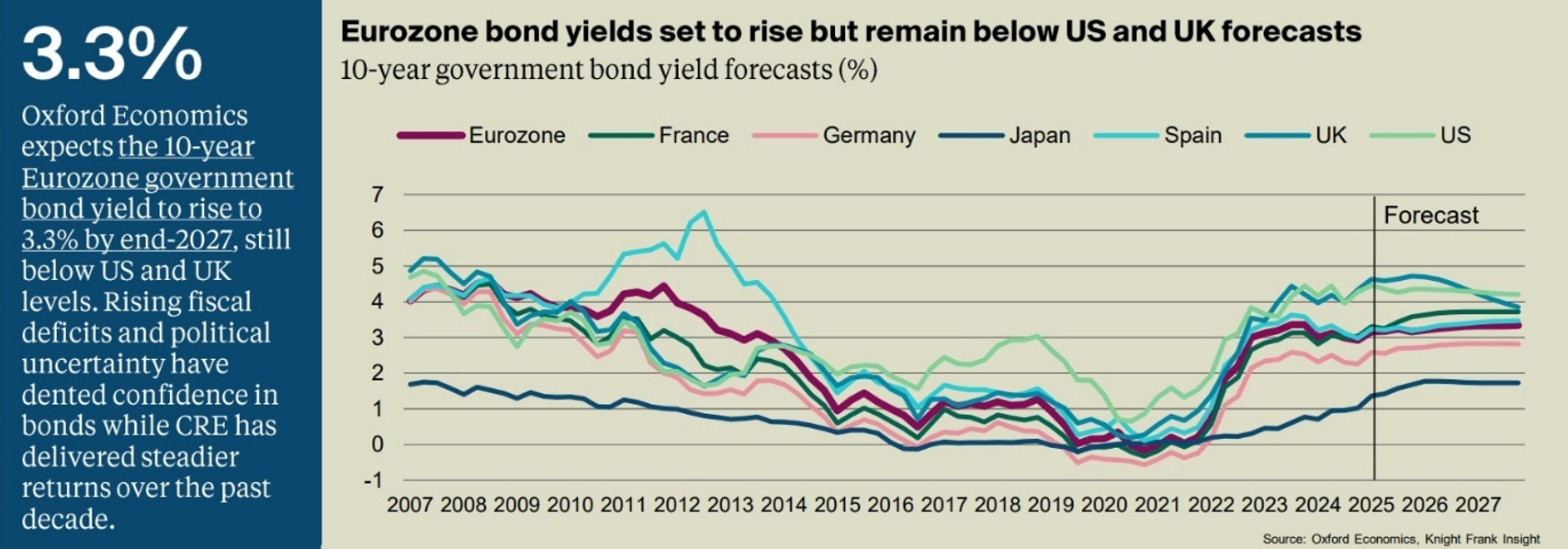

Oxford Economics expects the 10-year Eurozone government bond yield to rise to 3.3% by end-2027, still below US and UK levels. Rising fiscal deficits and political uncertainty have dented confidence in bonds while CRE has delivered steadier returns over the past decade. Our European Outlook 2026 explores the evolving nature of risk-free rates and the wider implications for investment strategy and decision-making in more detail.

-

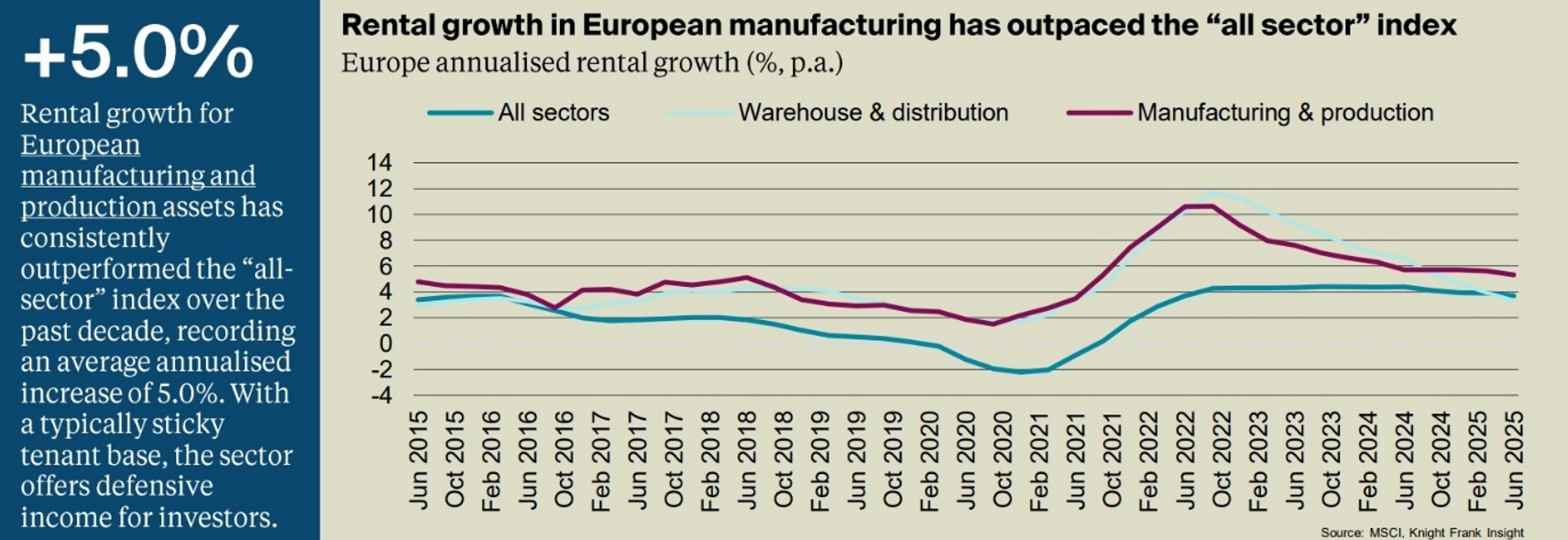

Rental growth for European manufacturing and production assets has consistently outperformed the “all-sector” index over the past decade, recording an average annualised increase of 5.0%. With a typically sticky tenant base, the sector offers defensive income for investors. For further insights into the sector, areas of growth and opportunities for investors, please see the report Manufacturing Opportunities in European Real Estate.

Explore the full European Leading Indicators dashboard for an in-depth analysis of market dynamics across Europe, including comprehensive data tables, interactive charts, and detailed commentary on investment trends, prime office rents, and growth projections.